cook county unpaid taxes

To see if your taxes are delinquent and to make a payment. Currently their are no Tax Forfeited Land Sales at this time.

Cook County Property Tax Sale To Be Held In November Treasurer Maria Pappas Announces Abc7 Chicago

Cook County Commissioner Bridget Gainer 118 N Clark St.

. Delinquent taxes less than 100 Parcels part of a Federal bankruptcy case Parcels in the process of being purchasedacquired by another local government entity Parcels issued a certificate of error by the Cook County Assessors Office Parcels. Late fees have been waived and delayed in Cook County considering the financial hardship and uncertainty that many taxpayers are facing due to COVID-19. Cook County sees very few tax forfeited properties.

Any unpaid balance due may then be subject to sale to a third party. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all.

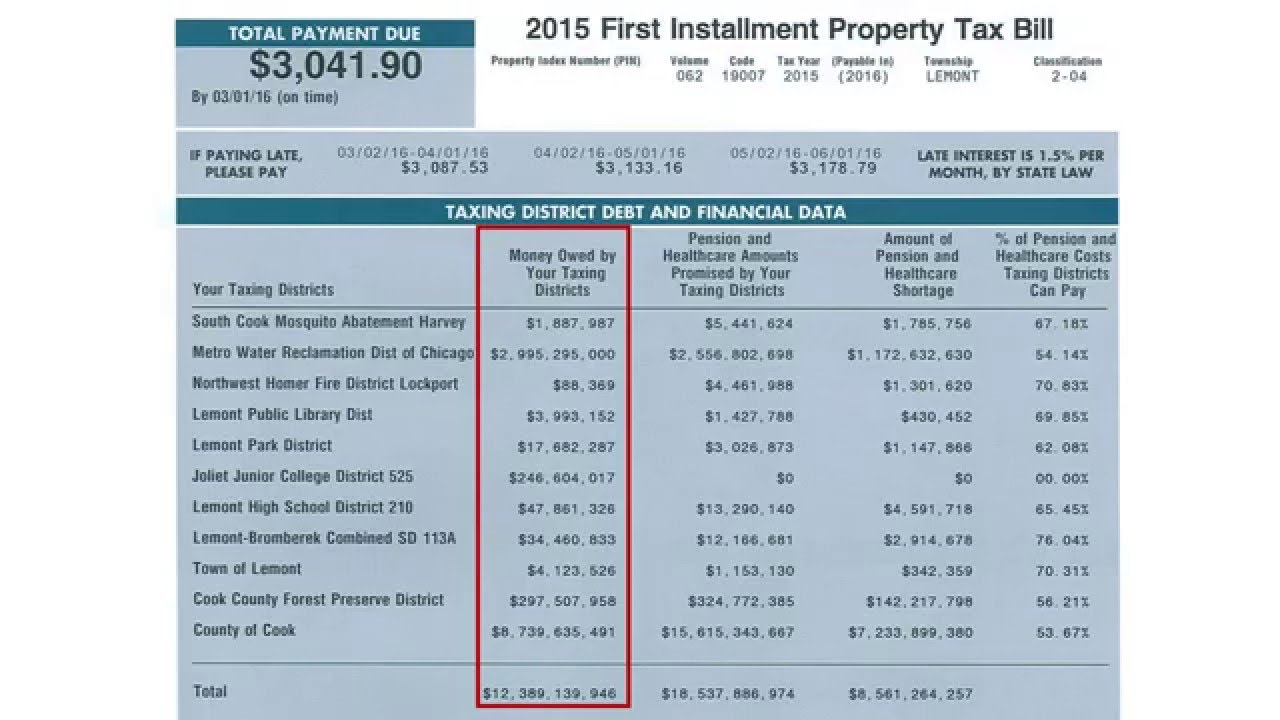

About 1634 million in unpaid 2018 property taxes that were to be paid in 2019 is due on 36000 homes businesses and land in Cook County Pappas said. Any unpaid balance due may then be subject to sale to a third party. Delinquent Cook County property taxes totaling 1896 million on 56976 properties is scheduled to be auctioned at the Annual Tax Sale that begins May 3 2019 Treasurer Maria Pappas said today.

Certified notice out on 45000 properties with unpaid taxes in Cook County. When delinquent or unpaid taxes are sold by the Cook County Treasurers office the Clerks office handles the redemption process which allows taxpayers to redeem or pay their taxes to remove the risk of losing their property. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of.

With the case number search you may use either the number assigned by the recorder of deeds or the number assigned by the circuit court. 8447145626 Home Savers Community Group is a family owned and operated property tax lender that helps property owners pay Cook County delinquent taxes. On May 12 2022 Cook County Treasurer Maria Pappas will begin the sale of unpaid 2019 property taxes that were originally due in 2020.

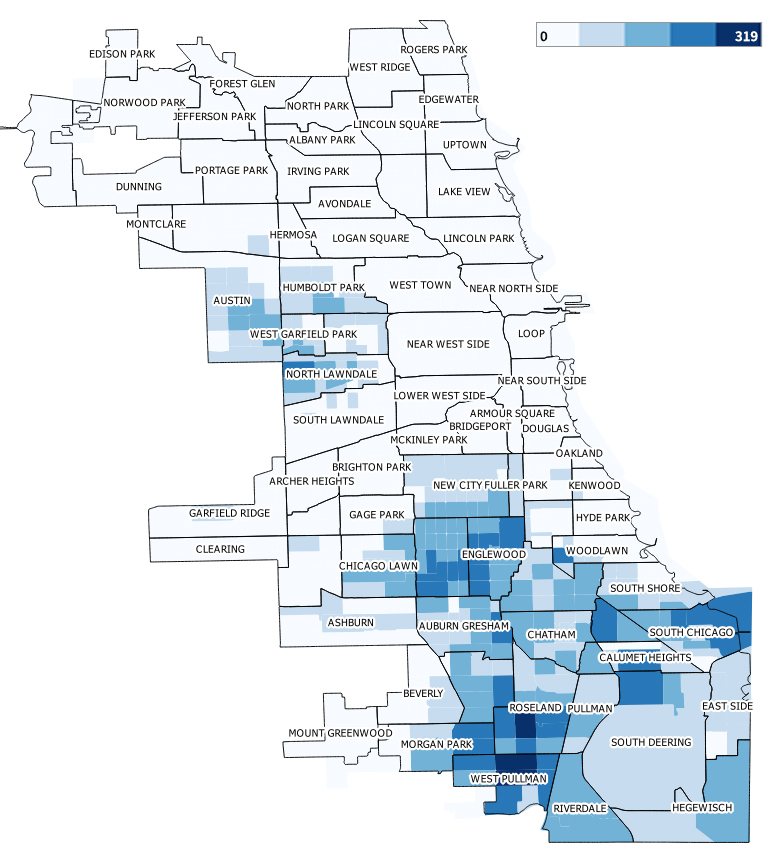

Cook County Delinquent Taxes Call Us Today. Also Be Unpaid 1841 LAWNDALE LLC 1841 N LAWNDALE AVE 499 S. Those lots have unpaid taxes attached to them and according to Cook County Treasurer Maria Pappas it adds up to 5 billion in lost property tax revenue.

Select a tab for detailed lists of properties with delinquent taxes for Tax Year 2019 payable in 2020 that are currently eligible for the Annual Tax Sale that begins May 12 2022. A property owner whose taxes were sold may redeem their taxes by paying the. Records for delinquent taxes for prior years.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Cook County IL at tax lien auctions or online distressed asset sales. The Countys Department of Revenue will audit real property transfer tax returns filed with the. The Annual Tax Sale is a yearly auction of delinquent taxes at which a tax buyer may pay the delinquent taxes due on a parcel.

Information on Delinquent Accounts. RIDGE RD LAKE FOREST IL 600452747 374 13-35-313-046-0000 00 2019 533140 716246 JEFFERSON Chicago Residential 1 8 4 2 Yes SST REAL ESTATE GROUP 1821 N KIMBALL AVE 7645 LOWELL AVE SKOKIE IL 600763713 375 13-35-409-015-0000 00 2019 569409 764895 JEFFERSON. Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

On an annual basis Cook County has a number of parcels where the taxes are delinquent. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. The properties are broken down by Chicago ward municipality township and commissioner district.

Tax Forfeited Land Sales If real estate taxes are left unpaid for a period of 3 to 6 years depending on classification the property is subject to forfeiture to the State of Minnesota. Each year thousands of Cook County property owners pay their real estate property taxes late or neglect to pay them at all. When that happens the unpaid taxes on these parcels are offered at an annual tax sale where the general public has the option to buy those unpaid taxes in the form of a certificate.

Cook County Treasurers Office - 3232022. Cook County Board President Toni Preckwinkle today announced her administration is establishing a new enforcement measure to go after businesses and individuals that avoid paying transfer taxes on real estate transactions by undervaluing the property they sell. Cook County Property Tax Sale List.

That is more than a fifth of the current. The Cook County Clerks office has a variety of property tax responsibilities. Property owners can avoid the Annual Tax Sale by paying the delinquent taxes and interest before the sale begins.

Many Illinois counties approved measures to delay property tax payment due dates in order to give temporary relief to struggling homeowners. Search to see if delinquent taxes have been sold or forfeited at the annual Cook County Tax Sale and if those taxes were subsequently redeemed paid. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate of the Cost of Redemption detailing the amount.

CHICAGO WLS Cook County Treasurer Maria Pappas is planning to conduct the first sale of delinquent property taxes in more than two years on November 5. Cook County Treasurer Maria Pappas changes 2022 Scavenger Sale to benefit bidders and communities. The certificate of lien filed with the circuit court is treated like a judgment of the court.

To search for a certificate of tax lien you may search by case number or debtor name. According to data from Cook County Treasurer Maria Pappas landlords have yet to pay about 6 percent of commercial property taxes.

Cook County Treasurer Maria Pappas Offers Help With Property Tax Problems Village Of Bellwood

Cook County Treasurer S Office Chicago Illinois

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Treasurer Announces Two Months Grace Period On Late Fees Chicago Association Of Realtors

Cook County Treasurer Cookcountytreas Twitter

Cook County Property Tax Payments Due Tuesday Online Payment Available Through Treasurer S Website Abc7 Chicago

Cook County Property Owner Tax Bill Payments Extended Until October 1st West Suburban Journal

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Treasurer S Office Chicago Illinois

Your Property Tax Debt Could Be Sold Quicker Than Ever This Year Downtown Chicago Dnainfo

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

First Installment Of Cook County 2021 Property Tax Bills Have Been Mailed Chicago Association Of Realtors

Cook County Treasurer Maria Pappas Abc7 Chicago Host Black And Latino Homes Matter Phone Bank For Property Taxes Refunds Abc7 Chicago

Cook County Property Tax Portal

Millions In Property Tax Refunds Exemptions Owed To Cook County Homeowners Nbc Chicago

Austintalks 30 000 Plus Properties In Cook County S First Tax Sale In More Than 2 Years Austintalks

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Property Tax Bills May Be Delayed By Inter Office Controversy Abc7 Chicago